Offre limitée

👋

Inscrivez-vous et recevez le code de réduction 10%

Offre limitée

Inscrivez-vous et recevez le code de réduction 10%

Financial entities need comprehensive ICT vendor oversight. Manual registers were "awful" to complete. Automate your way to compliance confidence.

Fintech platforms handle some of the most sensitive personal data out there. From payment details to tax and banking, you're swimming in data that regulators love to scrutinize.

Here's what keeps your team up at night:

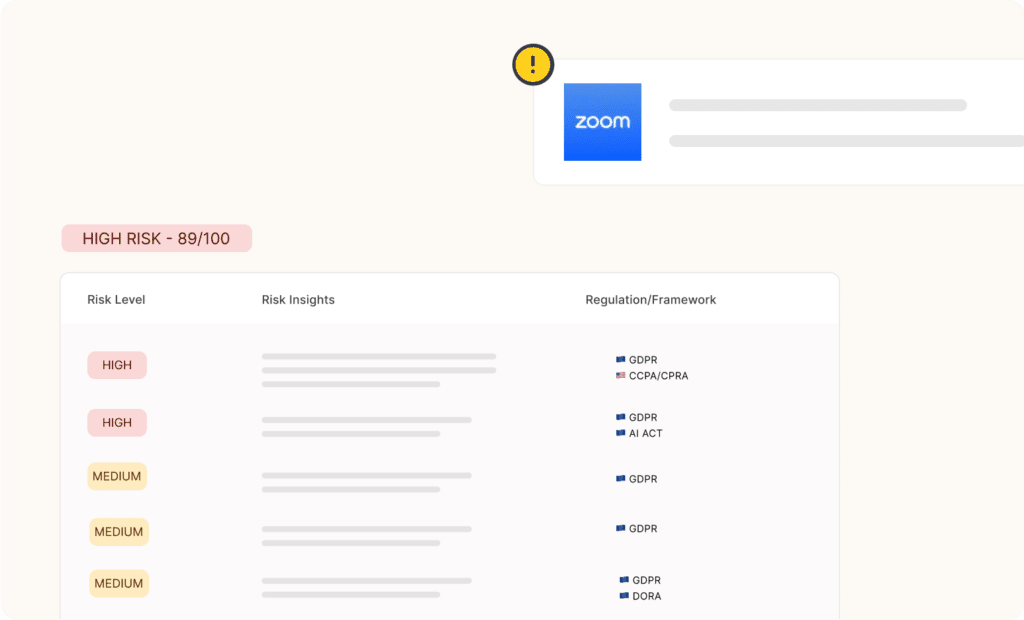

DORA/FINMA demands comprehensive oversight of your critical ICT providers, but identifying them is just the start. You need:

Robust reporting isn't just recommended—it's mandatory. This becomes even more critical with the impending DORA enforcement. But keeping track of all your critical providers and their critical providers can feel like mission impossible. How do you create and maintain a comprehensive view of your entire supply chain risk?

Financial institutions face a perfect storm of compliance challenges: mounting regulations like DORA and FINMA demand comprehensive third-party oversight. Most teams lack the resources, tools, and time to meet these requirements effectively, creating dangerous blind spots and putting them at risk of significant regulatory penalties.

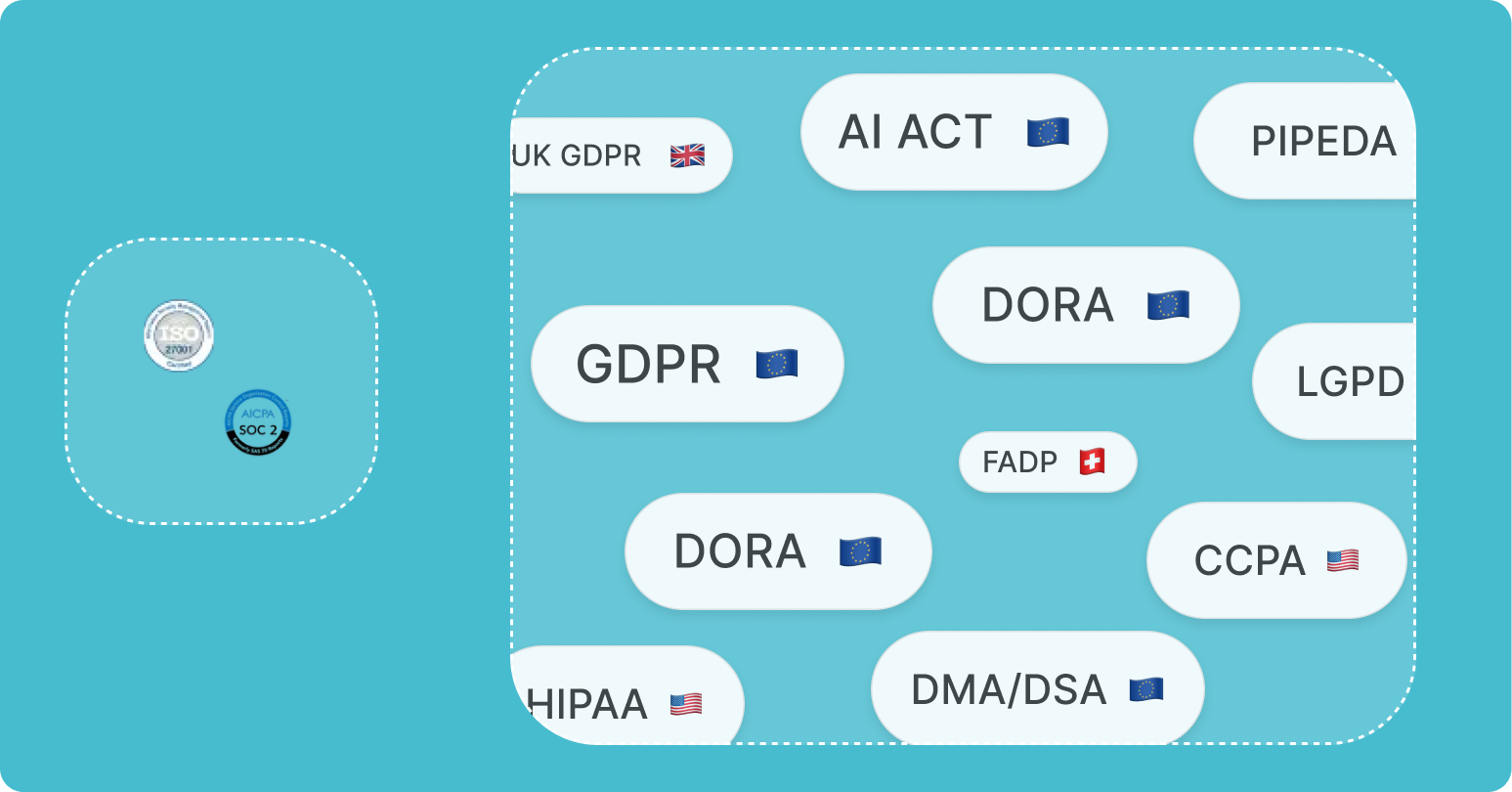

The regulatory landscape is changing fast. Luckily, with hoggo - you don't need additional tools every time it happens. We adjust faster than you drink your morning coffee.

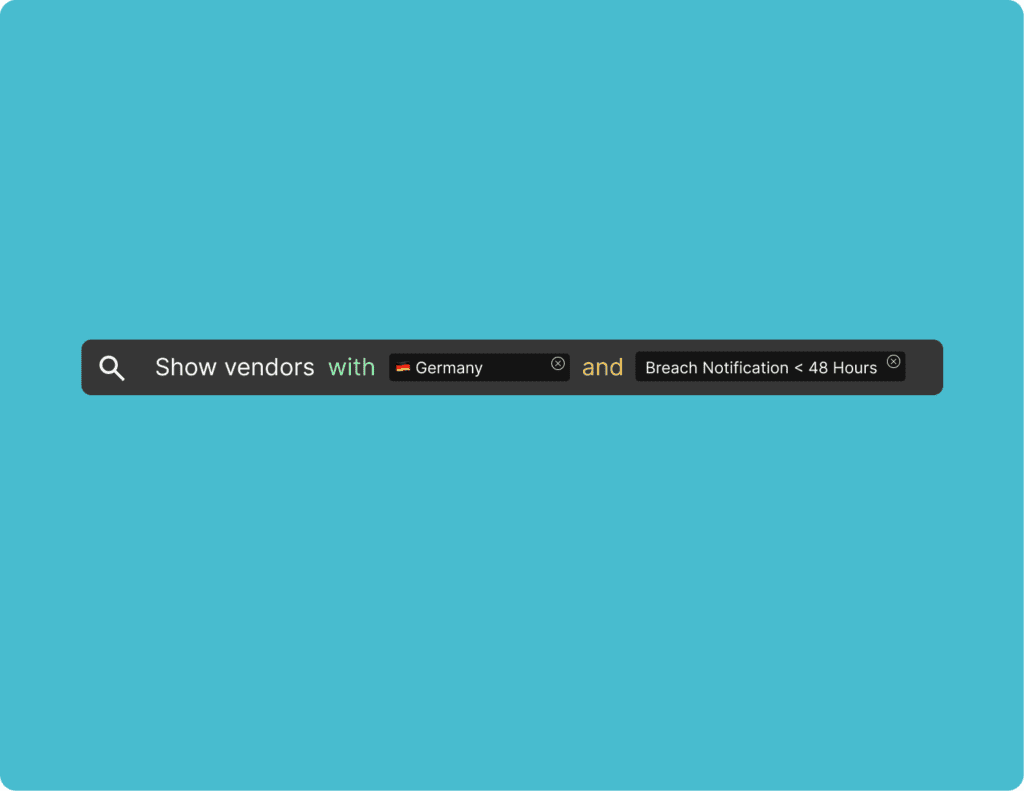

Compliance isn't just for security teams anymore. hoggo brings your legal, privacy, security, and operations teams together in one intuitive platform.

💰

👁️

🚀

Good Company

Nikolas Adamopoulos

CEO @ Talonic AI

"Meeting compliance requirements is a necessary yet time-demanding chore in our industry. hoggo allowed us to streamline most and focus on our core business"

Boryana Milova

Product & Growth @ EnableMe

"We collaborated with hoggo on our EnableMe Insights project and were impressed from the start by their approachability, competence, clear communication, and ability to explain complex topics in a way that non-legal or tech teams could easily understand. Thanks to their valuable support, we can now fully focus on the core of our project."

Alban Grossenbacher

CEO @ GoTom

"hoggo is a game changer. Before, compliance felt like a maze we were stumbling through. Now, we have clarity."

Lewin Keller

CEO @ CoachBot

"As an early-stage startup, navigating the maze of global providers, regulations, privacy policies, and DPAs can feel overwhelming. Staying afloat seemed impossible until we found hoggo. Their solution is a game changer!"

Ajouter {{itemName}} au panier

Ajouté {{itemName}} au panier